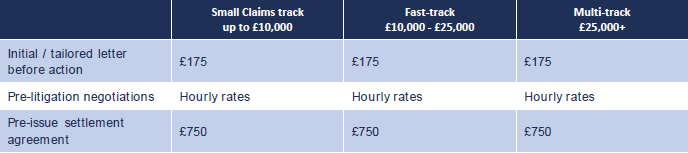

Pre-litigation fees

The fees below relate to work done prior to the issuing of court proceedings. All fees listed below are exclusive of VAT.

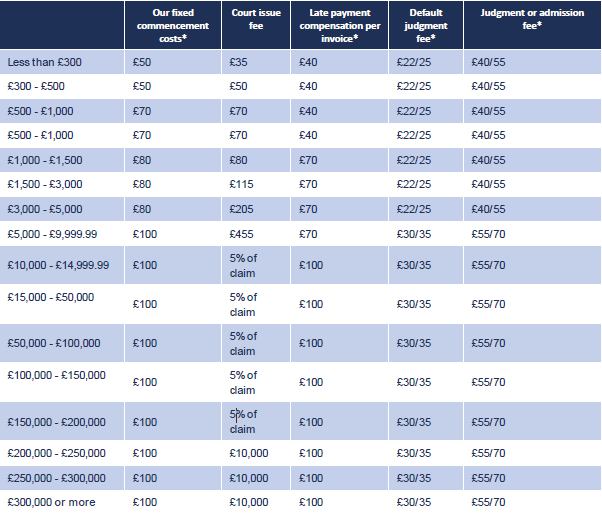

Where appropriate we will claim interest and compensation on commercial debts pursuant to the Late Payment of Commercial Debts (Interest) Act 1998. Compensation will be claimed in the amounts set out below and calculated per invoice claimed. Where a recovery is made of the compensation, we will invoice you 50% of that compensation.

Issuing court proceedings

Our price list for issuing court proceedings and entering judgment in default is as follows:

*If a full recovery is secured from your debtor, these fixed costs will be included within the amount recovered and there will be no additional charge to you. The judgment fee varies depending on whether or not a debtor files an acknowledgment of service or if the debtor files an admission.

Below is our additional price list for court proceedings and entering judgment in default where your debtor is based outside the jurisdiction of England and Wales:

*If your debtor's first language is not English, your debtor may try to delay your claim by refusing to accept service of the documents unless translated into its official language. If we cannot persuade the process server and/or the court that the debtor does, in fact, understand English, you will need to have the court papers translated. At that stage we will obtain a quote for translation costs and we will advise you accordingly.

**When serving the claim, you may have up to three options: (1) The Royal Courts of Justice offer a cross-border process service for which there is usually no fee. (2) Alternatively, you may possibly effect service by registered post which should cost no more than £20. (3) Finally, you may be able to instruct an agent to effect direct service. If you choose to effect direct service, we can obtain a quote beforehand.

***When seeking to enforce a judgment in a foreign jurisdiction we will need to take enforcement advice from a lawyer in that foreign jurisdiction.

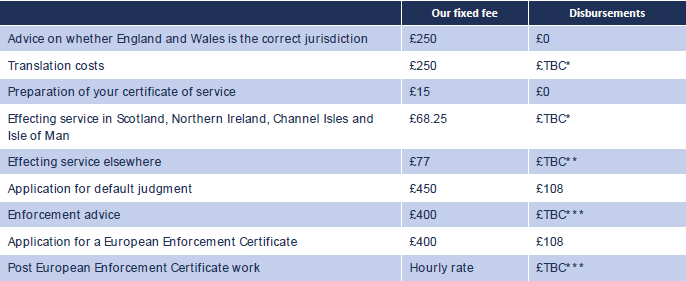

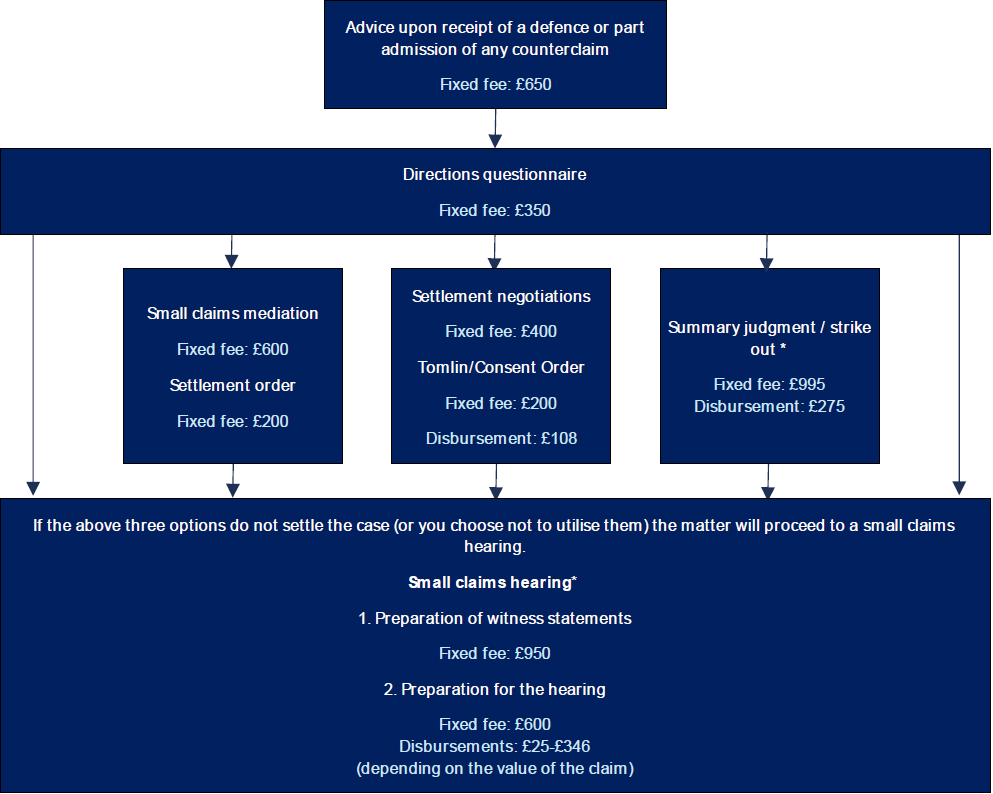

Defended recovery proceedings - small claims track

Where your claim is defended and the amount claimed is for less than £10,000 then the following fixed fees apply until conclusion or until the case is allocated to a different track by the court:

*It may be necessary to instruct counsel at this stage and a quote will be provided to you at the relevant time.

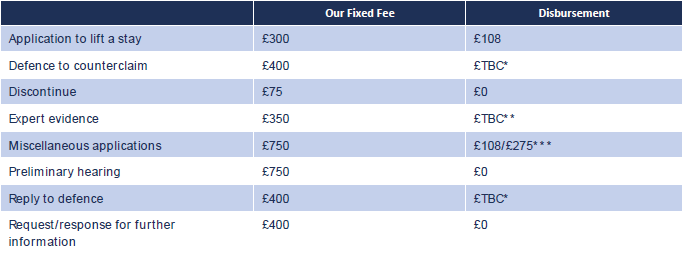

The previous flow chart sets out the normal way in which a small claims track case will progress through to trial. However, the litigation process can vary depending on the facts of a case and we offer fixed fees for the following possible stages, should they be necessary:

*Depending on the facts of the case, we may advise you to instruct counsel to draft your reply to defence or defence to counterclaim (if required) and we will obtain a quote for you at the relevant time.

**Expert fees will vary depending on the nature of the case and will be confirmed at the time.

***Depending on whether on notice/without notice.

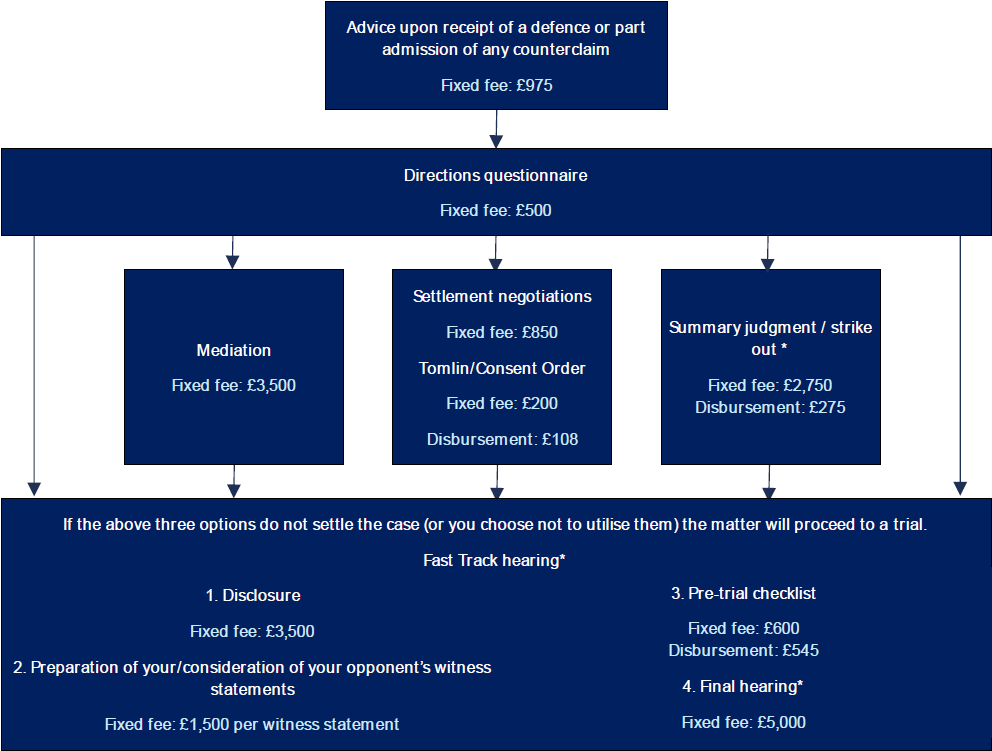

Defended recovery proceedings - fast-track claims

Where your claim is defended and the amount claimed is for more than £10,000 but less than £25,000 then the following fixed fees apply until conclusion or until the case is allocated to a different track by the court:

*It may be necessary to instruct counsel at this stage and a quote will be provided to you at the relevant time.

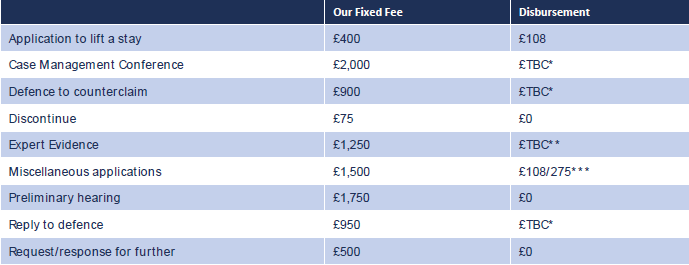

The previous flow chart sets out the normal way in which a fast-track case will progress through to trial. However, the litigation process can vary depending on the facts of a case and we offer fixed fees for the following possible stages, should they be necessary:

*We may advise you, depending on the facts of the case, to instruct counsel to draft your reply to defence or defence of counterclaim (if required) and we will obtain a quote for you at the relevant time. In addition, it may be necessary for counsel to attend a case management conference on your behalf.

**Expert fees will vary depending on the nature of the case and will be confirmed at the time.

***Depending on whether on notice/without notice.

Defended recovery proceedings – intermediate and multi-track claims

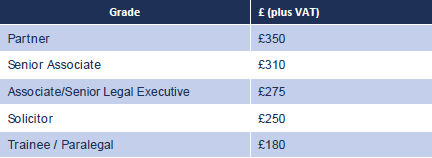

In contested intermediate and multi-track matters, being complex claims or those for more than £25,000, our standard hourly rates will apply from receipt of the defence until conclusion or until the case is allocated to a different track by the court:

These fees are reviewed in January each year.

A costs estimate will be provided following receipt of a defence and regular cost updates provided. We will utilise our standard monthly billing process. Our aim will be to try and recover most (if not all) of your costs from the debtor.

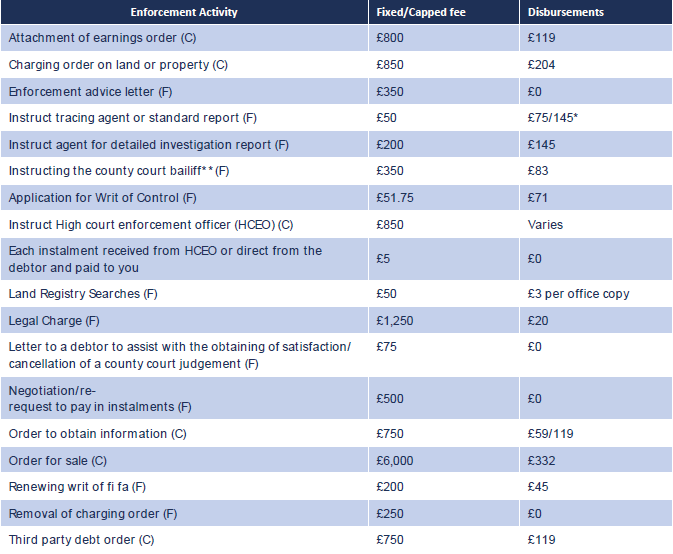

Enforcement Fees

Should you obtain judgment against a debtor and it does not pay the judgment debt, we can advise on the various methods of enforcement available to you. Our fixed (F) and capped (C) fees for enforcement are as follows:

(C) These costs are capped. Should our costs be below the capped cost we will limit our fees to the lesser amount.

(F) These costs are fixed.

*The agent’s fee for tracing individuals who owe a debt of less than £5,000 is £75 on a “no trace-no fee” basis. All other traces are for a fixed fee of £145.

**For debts under £600 a county court bailiff must be instructed. It is not cost effective for us to deal with him/her on your behalf, but we will prepare the instructing documentation on your behalf for the fixed fee stated above. The bailiff will then report directly to you.

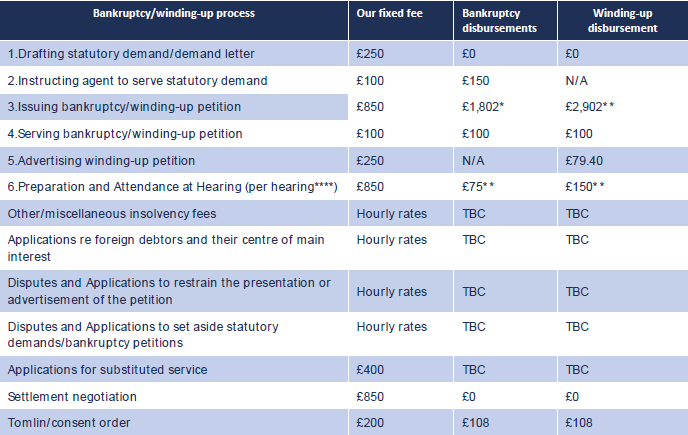

Insolvency Fees

You can, as an alternative to county court proceedings, commence insolvency proceedings if the debt is undisputed. The proceedings will take the form of bankruptcy proceedings if the debtor is an individual or winding-up proceeding if the debtor is a company.

There are a number of stages which must be followed throughout insolvency proceedings, these are as follows:

*The fee of £1,832 includes the official receiver's deposit of £1,500 of which £1,450 is refunded if a bankruptcy order is not made.

**The fee of £2,932 includes the official receiver's deposit of £2,600 of which £2,550 is refunded if a winding-up order is not made.

***Depending on the circumstances and the location of the hearing, we may need to send an agent to the hearing, and this is the agent's standard fee.

****In the event we are instructed to adjourn a hearing to allow your debtor further time to pay then the work done in that regard will be limited to 50% of the fixed fee of £850 for Preparation and Attendance at Hearing

Recovery Proceedings

PRE-LITIGATION

The first stage of the recovery proceedings is to send a letter before claim to your debtor. This will show the court that you have given your debtor an opportunity to pay the debt before court proceedings are issued. This letter before claim can often encourage the debtor to make payment before court proceedings are issued.

We will also claim interest on your debt and compensation on commercial debts pursuant to the Late Payment of Commercial Debts (Interest) Act 1998 if applicable. Where a full recovery is made of the compensation claimed we will invoice you 50% of that compensation.

Should the letter before claim encourage your debtor to make an offer of payment and negotiations are successful, you may need to record the terms of settlement in a settlement agreement and we can draft this for you for the fixed fee set out above.

ISSUING COURT PROCEEDINGS AND ENTERING JUDGMENT IN DEFAULT

Our fixed fees for this stage are limited to the fixed costs you can recover if your claim is successful and, in such cases, there will be no cost to you if a full recovery is made. You can also recover the court fee if you are successful in your claim.

Where possible we will issue proceedings via the Government's Money Claims Online Web Portal (MCOL) which will reduce the court fees payable by you.

CLAIMS OUTSIDE THE JURISDICTION

The next stage will be for us to advise whether the English and Welsh courts have jurisdiction to hear your claim. If we advise that they do, then the claim can be issued and our additional fixed costs will apply. Again, these are recoverable from your debtor if your claim is successful.

If your debtor fails to respond to the claim form, then we must apply for judgment in default. Our fixed cost of £450 + VAT is at the court's discretion and may not be recoverable from your debtor.

Should the judgment debt remain unsatisfied and your debtor is domiciled in a European member state then we can apply for a European Enforcement Certificate and our fixed fee of £400 + VAT will apply.

Defended claims

Once your debtor files a defence to your claim, the claim will normally be allocated to a particular 'track' based on its value. Once the mandatory stages of us providing our advice upon the receipt of your debtor's defence and preparing the directions questionnaire are complete, there are four usual ways of bringing the claim to an end:

If options 1,2 and 3 are attempted but are unsuccessful, then the claim will continue to a small claims hearing or a trial (depending on the track). When we receive your debtor's defence (and throughout the claim as it progresses), we will advise you on the merits of each option of bringing the claim to an end.

Enforcement

If you successfully obtain judgment against your debtor there are a number of ways you can enforce the judgment to try and secure a recovery of your judgment debt.

As soon as your debtor is in default of payment of a judgment debt, we will provide you with an enforcement advice letter which will set out full details of all the enforcement options which may be available to you based on the specific circumstances of your case and your debtor's own position.

In summary, the most common methods of enforcement available to you are as follows:

APPLY FOR AN ORDER TO OBTAIN INFORMATION

If you require further information about your debtor's financial status and/or assets, an application can be made to require the debtor to attend court for an oral examination. This may provide you with useful information regarding your debtor and his assets which you could look to enforce your judgment against. Failure to attend the hearing can result in the debtor being held in contempt of court.

ATTACHMENT OF EARNINGS ORDER

If your debtor is an individual and employed (not self-employed) then an application can be made for an attachment of earnings order. If successful, the court will order that you are entitled to be paid a certain proportion of the debtor's wage by his/her employer to satisfy your judgment debt.

CHARGING ORDER/ORDER FOR SALE

An application can be made to the court for a charging order if your debtor owns any property or land. If awarded, a charge is placed over the debtor's property or land, providing security for the value of your judgment debt.

If this does not produce payment from your debtor, you can then make an application to the court for an order for sale. This is an equitable remedy and is at the court's discretion. If granted, your debtor's property would be sold and, provided there is sufficient equity in the property, your judgment debt (and certain costs) would be satisfied in form of the proceeds of sale.

HIGH COURT ENFORCEMENT OFFICER (HCEO)

The HCEO could be instructed to attend upon your debtor's address and seek to levy execution upon any goods held there in order to satisfy the judgment debt. This method may encourage your debtor to make payment instead of assets being seized.

THIRD PARTY DEBT ORDER

If you are aware of anyone who owes your debtor money or if you have the debtor's bank details (perhaps from a previous cheque or bank transfer), you can make an application for a third party debt order. This is an order obtained from the court that the third party will pay the debt it owes to the debtor directly to you.

Insolvency

You can, as an alternative to court proceedings, commence insolvency proceedings if the debt is undisputed.

BANKRUPTCY

If your debtor is an individual, then you can commence bankruptcy proceedings. The debt must be undisputed and be at least £5,000 to enable you to present a bankruptcy petition.

A statutory demand must first be served on your debtor and if the debt remains unsatisfied after 21 days and there is no valid dispute to the debt, you can then proceed to issue and serve a bankruptcy petition.

WINDING-UP PETITION

Where your debtor is a corporate entity then you can commence winding-up proceedings. Again, the debt must be undisputed but needs to be more than £10,000.

In the case of corporate debtors, instead of a statutory demand, you are entitled to serve a three-day demand for payment on your debtor. Should the debt remain unsatisfied and there is no valid dispute to the debt after three days then you are entitled to issue and serve a winding-up petition.

Should you successfully obtain judgment against your debtor and it remains unsatisfied you may also wish to consider using the insolvency procedures set out above to enforce payment of the judgment.

Bexley Beaumont Limited, trading as Bexley Beaumont, is a limited company registered in England and Wales, with company registration number 12216664. it is authorised and regulated by the Solicitors Regulatory Authority (SRA Number: 664870). A list of directors is displayed at the registered office: Centurion House, 129 Deansgate, Manchester, M3 3WR, together with a list of those designated as partners. The title ‘Partner’ is a professional title only. Our Partners are not partners in the legal sense. They are not liable for the debts, liabilities or obligations, nor are they involved in the management of Bexley Beaumont.

Cookie Policy - Complaints & Grievance Policies - Privacy PolicyBexley Beaumont Limited, trading as Bexley Beaumont, is a limited company registered in England and Wales, with company registration number 12216664. it is authorised and regulated by the Solicitors Regulatory Authority (SRA Number: 664870). A list of directors is displayed at the registered office: Centurion House, 129 Deansgate, Manchester, M3 3WR, together with a list of those designated as partners. The title ‘Partner’ is a professional title only. Our Partners are not partners in the legal sense. They are not liable for the debts, liabilities or obligations, nor are they involved in the management of Bexley Beaumont.